With the Canadian Federal Budget 2023 announcement on March 28, 2023, came the confirmation of the Clean Technology Investment Tax Credit and the Clean Electricity Investment Tax Credit.

These are significant incentives effecting businesses by allowing cost deductions for renewable energy to increase the long term efficiency of your business operations. We will break down the differences of these ITC’s to help you better understand which will apply to your business and outline the savings .

It’s no secret that business owners have been challenged with increasing costs making it more difficult than ever to remain competitive. Imagine eliminating your electricity costs, or drastically reducing them! Electricity is a continuously increasing ‘fixed’ cost to your business. Installing solar panels allows you to produce your own electricity which reduces your electricity costs immediately, while protecting your business from increasing utility costs. Not to mention, telling your customers about the renewable energy generated from your solar panels is a valuable marketing message that shows you and your business are taking action to preserve our environment and reduce greenhouse gas emissions.

Clean Technology ITC

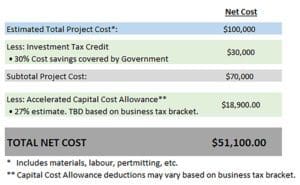

The Clean Technology Investment Tax Credit allows for-profit businesses to have 30% of the solar installation cost covered by the federal government. The Clean Technology ITC can be combined with other incentives, such as the Capital Cost Allowance which allows businesses to write down 100% of the solar installation cost in year 1. The example below shows how these incentives are combined to maximize your savings, which equates to a savings of 49%!

Details on how businesses can claim this tax credit are yet to be released. We are monitoring this and will updated this post with information as it’s released.

Clean Electricity ITC

The Clean Electricity Tax Credit is similar to the Clean Technology ITC, but the difference is that the Clean Electricity Investment Tax Credit applies to non-taxable business entities such as Crown corporations and Indigenous owned businesses. Businesses qualifying for the Clean Electricity ITC will have 15% of the solar installation costs covered by the government.